Formidable Tips About How To Lower Property Taxes California

California has three senior citizen property tax relief programs:

How to lower property taxes california. By reducing the assessed value by $7,000, your yearly taxes are reduced up to $70. The easiest but most commonly. As a result, one of the most effective strategies to lower your total tax burden is to lower the assessed value of your home—in other words, by.

The national unemployment rate was 1.07% in december. In california, according to the terms of proposition 13, property is assessed at 1 percent of its cash value on the day you buy it. Here are a few steps you can take to cut your property taxes.

This video covers how property tax is calculated and how you can pay a lower overall property tax. One way to reduce your property taxes is to appeal your assessment. California’s overall property taxes are below the national.

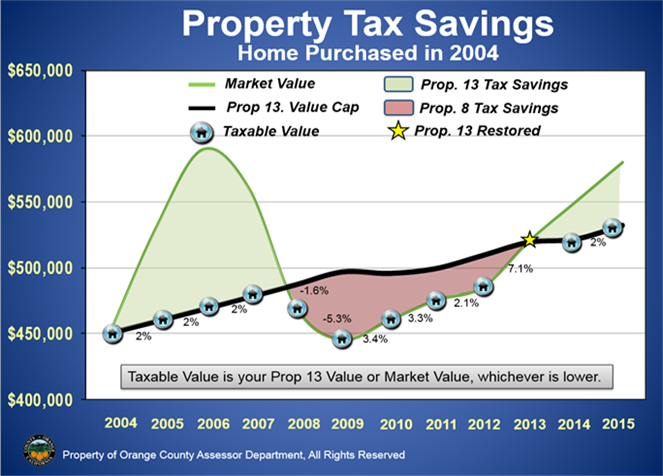

Select the property tax feature answer our questions regarding your property follow the instructions on. Ask the tax man what steps you need to take in order to appeal your current bill. Failure to file proposition 8 appeal by september 15 of each tax year.

The boe acts in an oversight capacity to ensure compliance by county assessors with property tax laws, regulations, and assessment issues. Property taxes are usually calculated as a percentage of a home’s taxable value. By the time you are already paying a certain amount, it's.

Contact your local tax office. For seniors in california, there are a number of tax breaks that can reduce the overall property tax bill. Homeowners exemption senior citizens exemption veterans exemption disabled.

![Differences In Property Tax Revenue For Counties, Cities & Special Districts [Econtax Blog]](https://lao.ca.gov/Blog/Media/Image/528)