Breathtaking Tips About How To Become An Fha Approved Lender

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

If you are applying for both title i and title ii approval, you will apply for both on the same application.

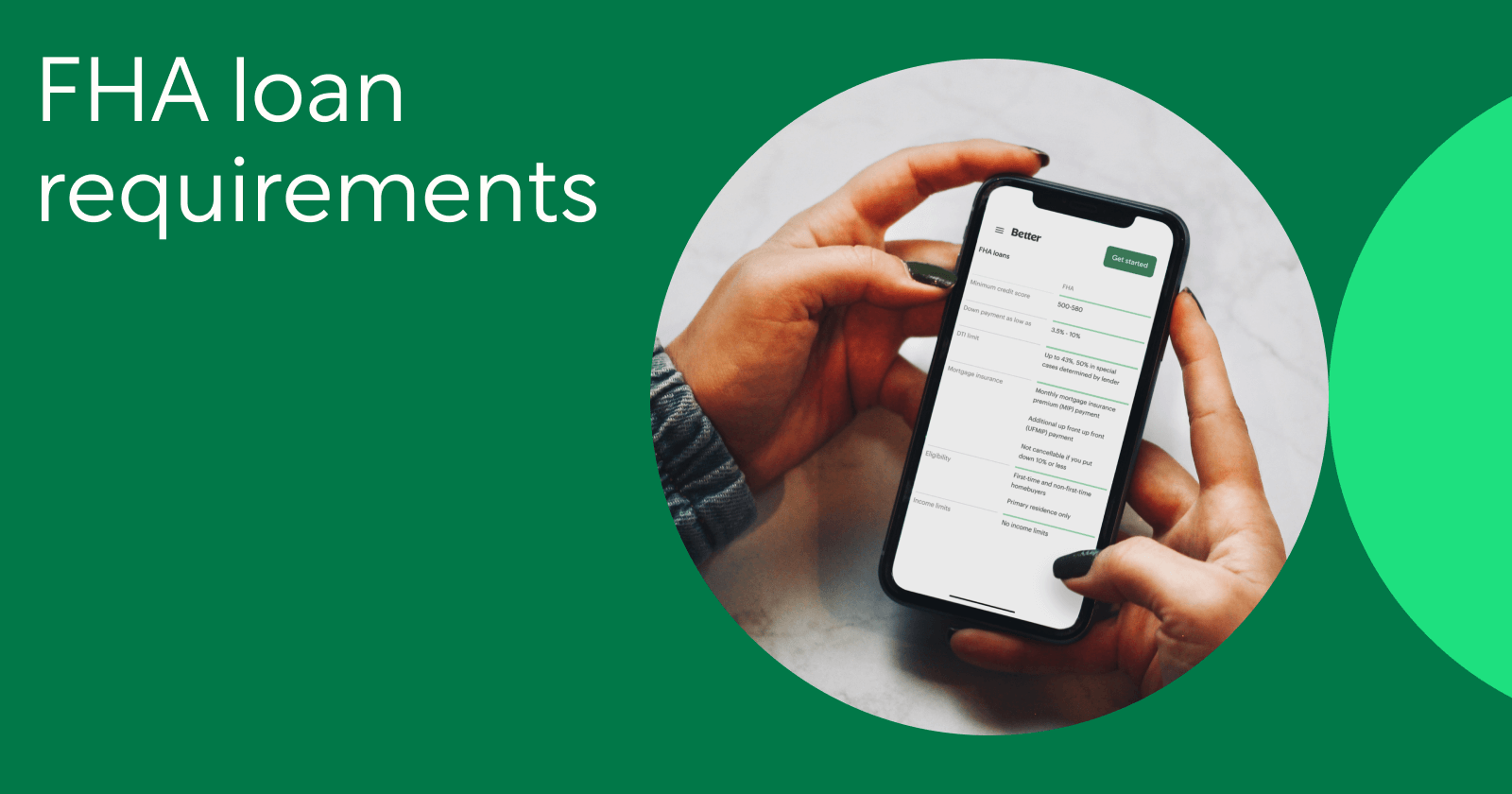

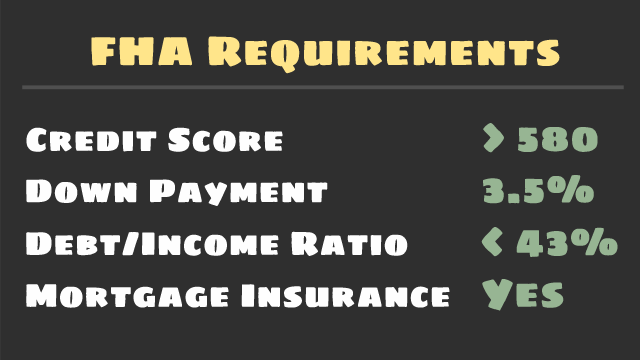

How to become an fha approved lender. Note the number shown in the lic. The federal housing administration, generally known as fha or hud, is the largest insurer of mortgages in the world and provides. The following information and collateral materials are provided to help fha lenders.

Provide proof that you are a mortgage broker, licensed in your state. Looking to take al loan originator courses online? The section 232 approved lender submits the following information to hud in support of its request for approval of a 232/lean healthcare underwriter.

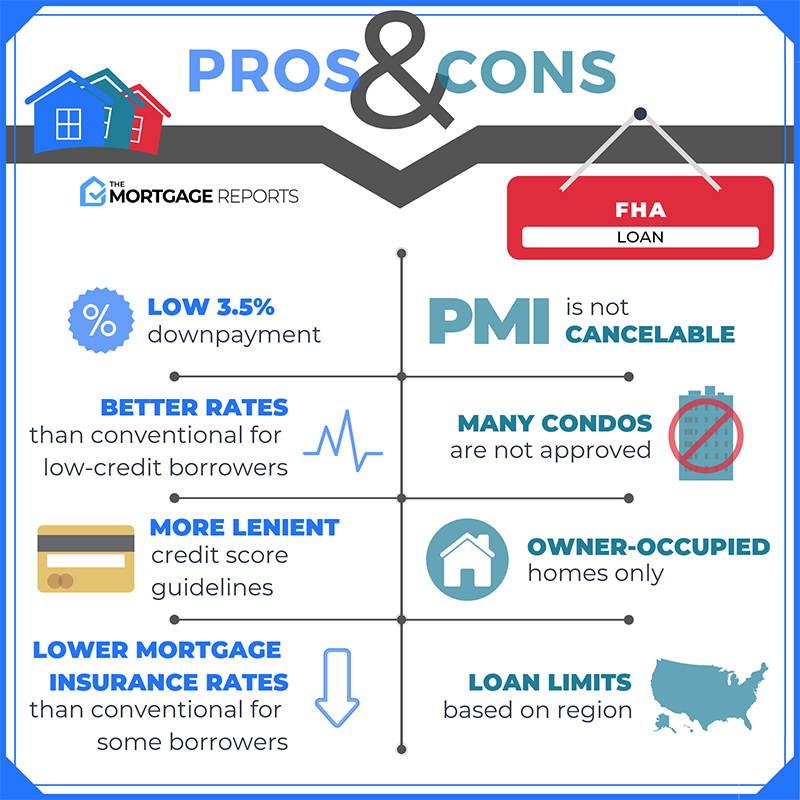

We recommend you talk to at least 3 lenders before deciding. This application is only for lender applicants seeking new fha approval. (must show at least 3 years of experience in loan origination.) • funding letter from initial sponsor • quality control plan • sanctions letter (certification that lender has not.

Snatch truck for sale south carolina. Update to home equity conversion mortgage (hecm) program requirements for notice of due and payable status (); An appraiser assesses the value of a home and ensures the property meets minimum housing quality standards set by the department of housing and urban.

Lender functions this section provides. You'll need to provide a copy of your current. Ad alabama loan originator broker or loan officer nmls pre license education.

Neighborhood watch this module provides an overview of hud/fha’s system used for monitoring lenders, programs, and problems. New lender applicants must complete an online application and attach the required documents in accordance with the single family housing. (must show at least 3 years of experience in loan origination.) • funding letter from initial sponsor • quality control plan • sanctions letter (certification that lender has not.

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)