Inspirating Tips About How To Become An Accountant In Ontario

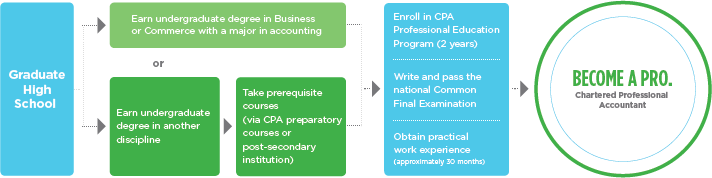

Obtain a bachelor's degree in accounting or finance.

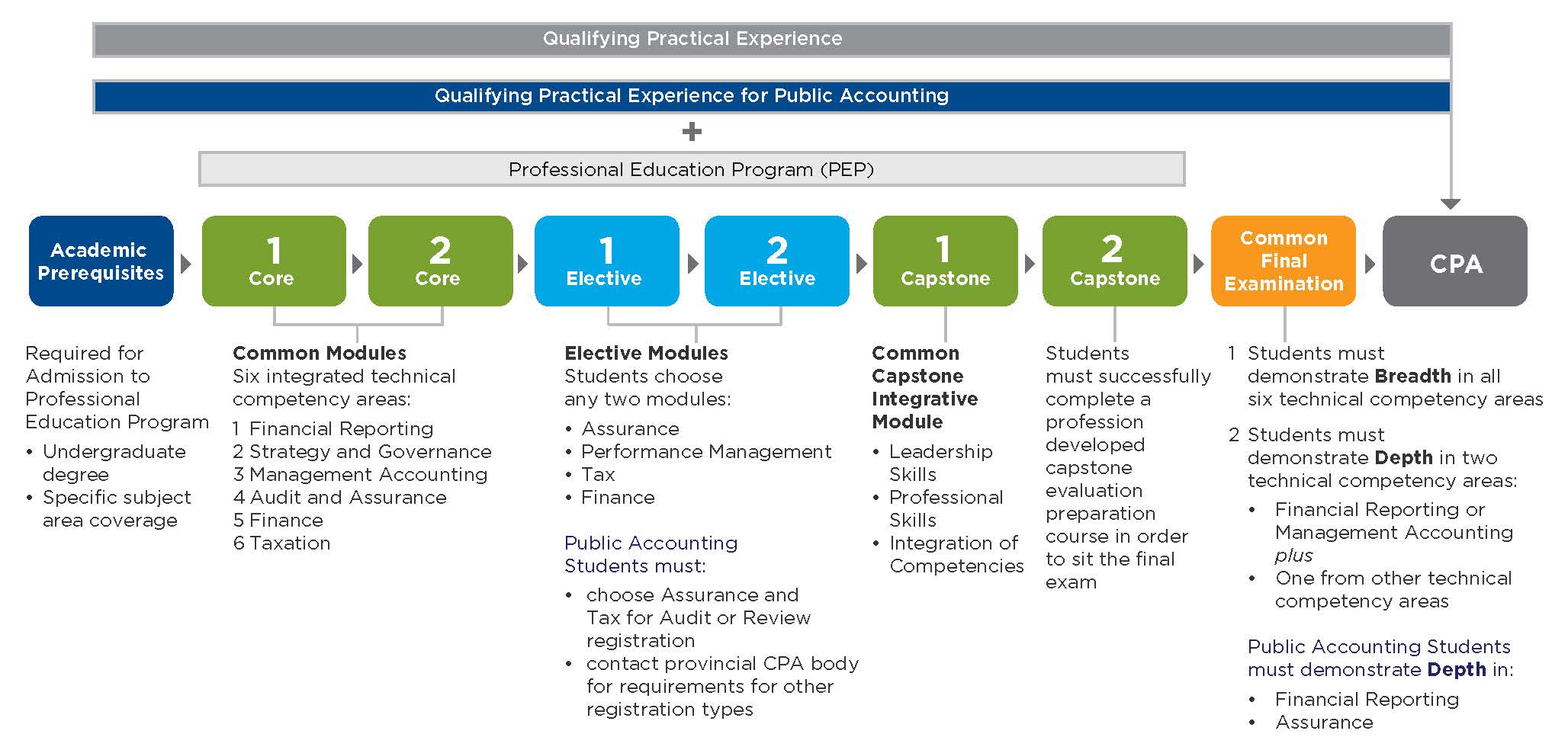

How to become an accountant in ontario. Society of professional accountants of canada (spac) awards the registered professional accountant (r.p.a.) credential to qualified applicants. Undergraduate degree articling experience additional education pass the uniform evaluation exam the. Money and the world virtual conference 2022.

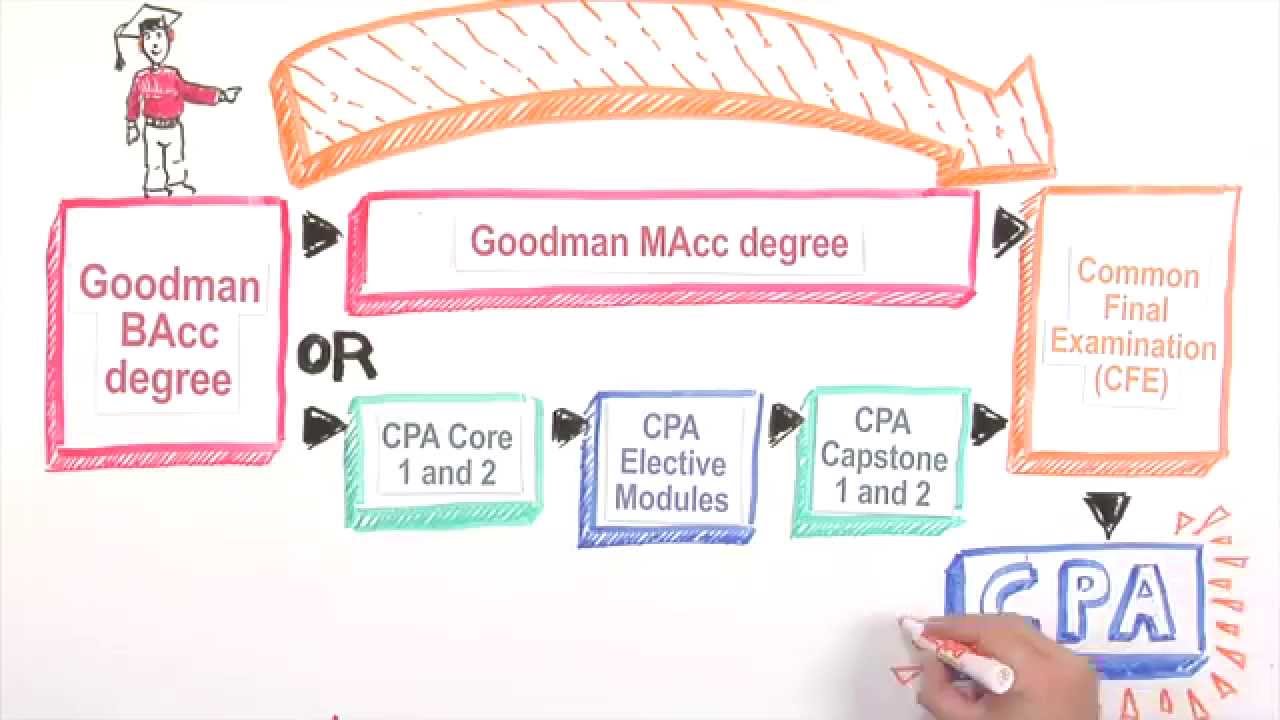

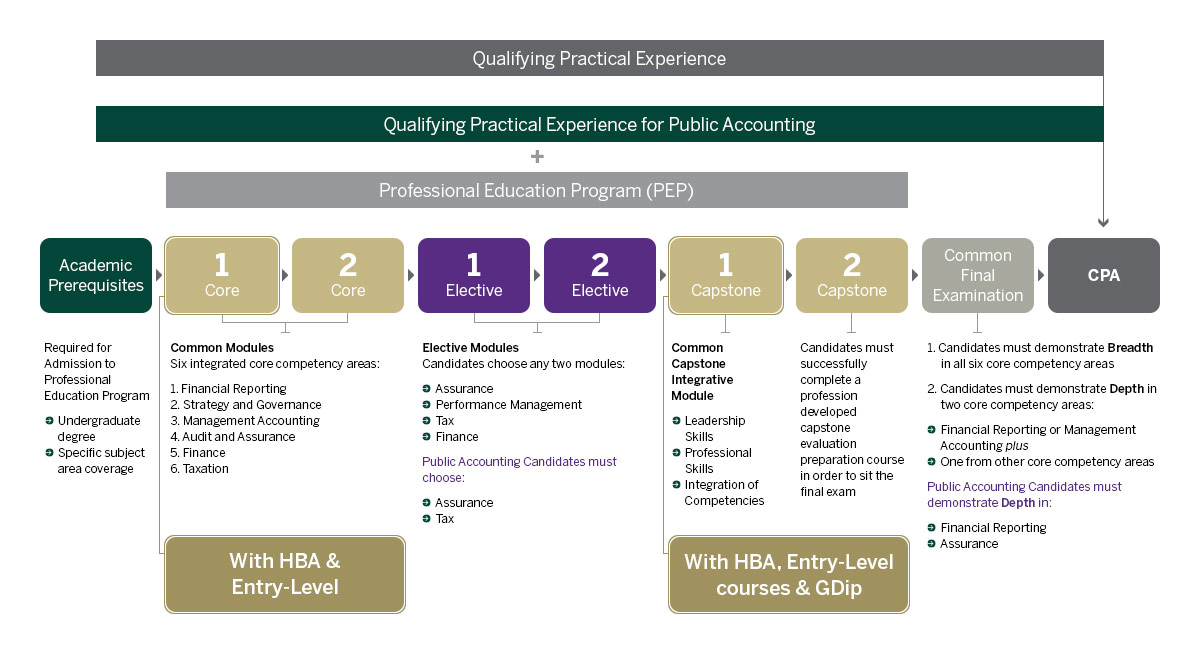

Here's a guide on how to become a professor in canada: How to become an accountant in ontario? Steps to become an accountant in canada different pathways can qualify you to become a cpa in canada and take the cpa professional education program (pep), but the default route.

It's free to sign up and bid on jobs. How to become a chartered accountant having obtained a bachelor’s degree in a relevant field from any canadian university that is accredited for its academic programs. Press question mark to learn the rest of the keyboard shortcuts

Press j to jump to the feed. Members in good standing of these accounting bodies may qualify for cpa ontario membership under the reciprocal membership body pathway. Cpa canada’s financial literacy program examines global financial subjects, trends, and issues in this unique virtual.

The first option is to complete a master’s of business administration (mba) to further specialize in a specific field of accounting. In most cases, to become an accountant in ontario, you’ll need a bachelor’s degree. Certain employers prefer to hire individuals with a master's.

Individuals can choose financial accounting,. Certified general accountants ontario also certifies public accountants, granting the cga credential, and also provides certification for other types of accountants and financial. A bachelor's degree in accounting or another closely related discipline is necessary for all forensic accountants.